Yes, it is possible to refinance your car loan through the same lender. Refinancing your car loan can help you save money by getting a lower interest rate or extending the loan term. By refinancing with your current lender, you may be able to simplify the process and avoid having to establish a new relationship with another lender.

However, it’s important to compare rates and terms from other lenders as well to ensure you’re getting the best deal.

Benefits of Refinancing Your Car Loan Through the Same Lender

Refinancing your car loan can be a smart financial move that can save you money and provide you with more favorable loan terms. While many people may think of refinancing as switching to a new lender, there are actually several benefits to refinancing your car loan through the same lender.

In this section, we will explore these benefits in detail.

1. Streamlined Process

One of the biggest advantages of refinancing your car loan with the same lender is the streamlined process. Since you are already an existing customer, the lender will have all your information on file, making the refinancing process quicker and easier.

You won’t have to provide extensive documentation or go through a lengthy approval process all over again. This can save you valuable time and effort.

2. Familiarity with the Lender

Refinancing through the same lender means that you are already familiar with their policies, procedures, and customer service. You have an established relationship with the lender, which can work in your favor during the refinancing process.

The lender already knows your payment history and creditworthiness, which can result in more favorable loan terms and conditions.

3. Potential for Better Interest Rates

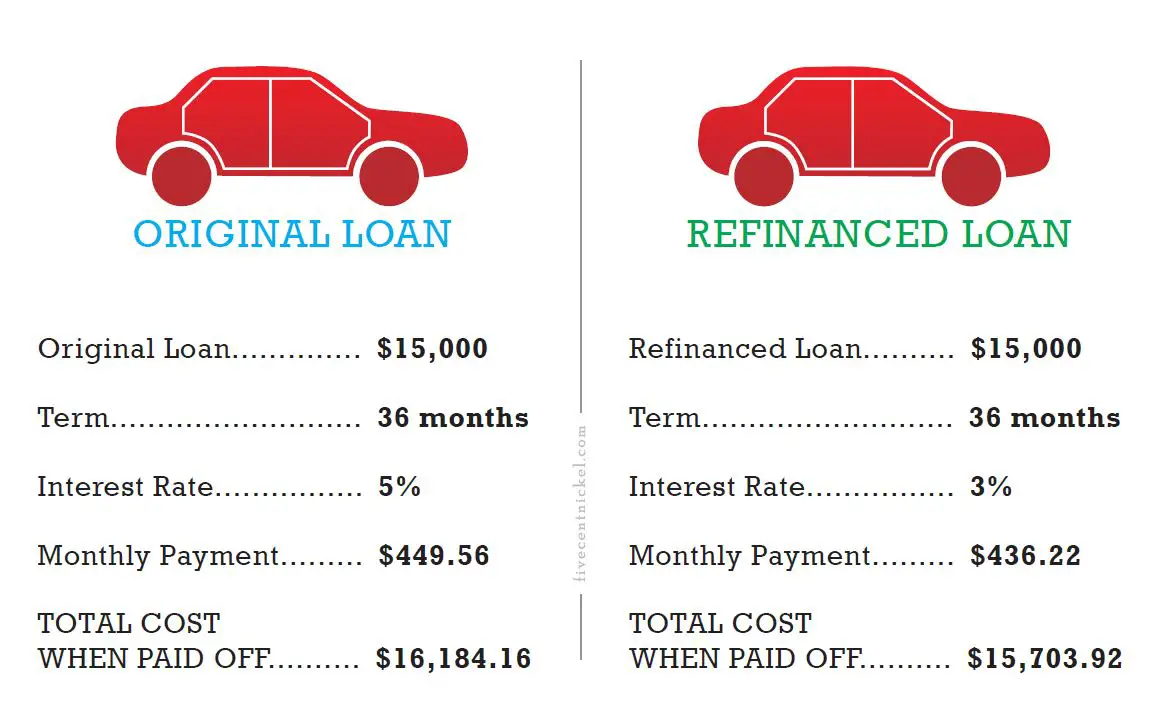

When you refinance your car loan through the same lender, there is a possibility of securing better interest rates. This is especially true if your credit score has improved since you originally took out the loan.

The lender may be willing to offer you a lower interest rate as a valued customer, which can significantly reduce your monthly payments and save you money in the long run.

4. Simplified Payment Management

Refinancing your car loan with the same lender can simplify your payment management. Instead of dealing with multiple lenders and loan accounts, you will only have one loan and one lender to keep track of. This can make it easier to budget and stay organized, as you won’t have to juggle different due dates and payment amounts.

5. Potential for Additional Benefits

Refinancing through the same lender may open up the possibility of additional benefits. Some lenders offer perks and rewards for customer loyalty, such as lower fees, flexible repayment options, or even cashback incentives.

By refinancing with your current lender, you may have access to these extra benefits that can further enhance your overall borrowing experience.

6. Preserve Your Credit Score

When you refinance your car loan through the same lender, it helps preserve your credit score. Each time you apply for a new loan or credit, it can have a temporary negative impact on your credit score. By refinancing with your existing lender, you can avoid multiple credit inquiries and minimize any potential negative effects on your credit rating.

How to Determine if Refinancing with the Same Lender is the Right Option for You

Refinancing your mortgage can be a smart financial move, allowing you to potentially lower your interest rate, reduce your monthly payments, or even pay off your loan faster. If you’re considering refinancing, you may wonder if sticking with your current lender is the best choice.

In this section, we will discuss how to determine if refinancing with the same lender is the right option for you.

1. Evaluate Your Current Mortgage

The first step is to evaluate your current mortgage terms. Take a close look at your interest rate, remaining loan term, and monthly payments. Consider how these factors align with your financial goals. If your current interest rate is higher than the current market rates, refinancing with your existing lender could potentially save you money in the long run.

2. Research Other Lenders

Before deciding whether to refinance with your current lender, it’s essential to do some research on other lenders in the market. Compare interest rates, fees, and loan terms offered by different lenders. This will give you a sense of the options available to you and help you determine if your current lender is providing you with the best deal.

3. Consider the Benefits of Staying with Your Current Lender

Refinancing with the same lender offers certain advantages that may make it an attractive option. For instance:

- Your current lender may offer you a streamlined process with less paperwork and faster approval times.

- You may already have an established relationship with your lender, which can be beneficial in negotiating better terms.

- If you have a good payment history with your current lender, they may be more willing to work with you to customize your loan terms.

Consider these benefits and assess whether they outweigh the potential advantages of switching to a new lender.

4. Compare Loan Offers

If you decide to stick with your current lender, it’s still important to compare loan offers from other lenders. This will help you ensure that you are getting the most competitive terms and rates possible. It’s always wise to shop around and gather multiple quotes before making a final decision.

5. Review the Costs of Refinancing

Refinancing comes with costs, such as closing fees, appraisal fees, and other associated expenses. Before refinancing with your current lender, carefully review these costs and compare them with the potential savings you could get from refinancing. Make sure that the overall financial benefit of refinancing outweighs the costs involved.

6. Seek Professional Advice

When making such an important financial decision, it’s always a good idea to seek professional advice. Consider consulting with a mortgage broker or financial advisor who can provide you with personalized guidance based on your specific situation.

They can help you weigh the pros and cons of refinancing with your current lender and ensure that it aligns with your long-term financial goals.

Step-by-step guide to refinancing your car loan with the same lender

Refinancing your car loan can be a smart financial move if you want to lower your monthly payments, reduce your interest rate, or change the terms of your loan. And if you’re already happy with your current lender, refinancing with the same lender can make the process even easier. Here’s a step-by-step guide to refinancing your car loan with the same lender:

1. Gather necessary documents

Before you start the refinancing process, gather all the necessary documents that your lender may require. This typically includes your driver’s license, proof of insurance, vehicle registration, and your current loan account information. Having these documents ready will help streamline the process and ensure a smooth refinancing experience.

2. Review your current loan terms

Take some time to review the terms of your current car loan. Look at the interest rate, monthly payments, loan duration, and any other relevant details. This will help you determine what changes you want to make when refinancing with the same lender.

Whether you want to lower your interest rate, extend the loan term, or modify any other terms, knowing your current loan details will guide your refinancing decisions.

3. Contact your lender

Once you have gathered the necessary documents and reviewed your current loan terms, reach out to your lender to express your interest in refinancing. Contact their customer service department or the representative you have been working with previously. They will guide you through the process and provide the necessary information on how to proceed.

4. Submit a refinancing application

Your lender will require you to complete a refinancing application as part of the process. This application will ask for your personal information, income details, and the requested changes to your loan terms.

Fill out the application accurately and provide any additional documentation they may require. Submit the completed application along with the supporting documents to your lender.

5. Wait for approval

After submitting your refinancing application, the next step is to wait for approval from your lender. They will review your application, verify the information provided, and assess your eligibility for refinancing. The approval process may take some time, so be patient during this stage.

6. Review the new loan terms

If your refinancing application is approved, your lender will provide you with the new loan terms. Take the time to carefully review these terms before accepting the offer. Pay close attention to the interest rate, monthly payments, loan duration, and any other modifications made to the original loan agreement.

7. Sign the refinancing agreement

If you are satisfied with the new loan terms, sign the refinancing agreement provided by your lender. Ensure that you understand all the terms and conditions outlined in the agreement before signing. If you have any questions or concerns, don’t hesitate to reach out to your lender for clarification.

8. Pay off your old loan

Once the refinancing agreement is signed, your lender will handle the process of paying off your old loan. They will coordinate with the previous lender to settle the remaining balance. It’s essential to continue making payments on your old loan until you receive confirmation that it has been paid off.

9. Start making payments on the new loan

With your old loan paid off, it’s time to start making payments on your new loan. Be sure to set up automatic payments or adjust your payment method as necessary. Stay organized and stay on top of your new loan payments to avoid any late fees or penalties.

10. Enjoy the benefits of refinancing

Now that you have successfully refinanced your car loan with the same lender, you can enjoy the benefits. Whether it’s a lower interest rate, reduced monthly payments, or modified loan terms, refinancing can provide you with improved financial flexibility and savings over the life of the loan.

Common Mistakes to Avoid When Refinancing with the Same Lender

Refinancing your mortgage can be a smart financial move that allows you to take advantage of lower interest rates or access your home’s equity. While it may seem convenient to stick with your current lender for the refinancing process, there are some common mistakes that borrowers make when refinancing with the same lender.

By being aware of these mistakes and taking steps to avoid them, you can ensure a smooth and successful refinancing experience.

1. Not shopping around for other lenders

One of the biggest mistakes borrowers make when refinancing with the same lender is not shopping around to compare offers from other lenders. While your current lender may offer you a refinancing option, it’s important to explore other options to ensure you’re getting the best deal.

Different lenders may have different interest rates, fees, and terms, and by not shopping around, you may miss out on potentially better terms that could save you money in the long run.

To avoid this mistake, take the time to research and compare offers from multiple lenders. Look at the interest rates, fees, and closing costs associated with each offer. Consider reaching out to a mortgage broker who can help you navigate the refinancing process and provide you with multiple options to choose from.

2. Assuming loyalty will be rewarded

Some borrowers mistakenly assume that their loyalty to their current lender will be rewarded when refinancing. They believe that because they have a history with the lender, they will automatically receive preferential treatment or better terms. However, this is not always the case.

When refinancing, it’s important to remember that lenders are businesses and their primary goal is to make a profit. Loyalty alone may not be enough to secure the best refinancing terms. Always do your due diligence by comparing offers from different lenders and negotiating for the best possible terms.

3. Not reviewing the new terms carefully

Another common mistake borrowers make when refinancing with the same lender is not carefully reviewing the new loan terms.

It’s important to thoroughly read and understand the terms of the new loan agreement, including the interest rate, repayment period, and any fees associated with the refinancing. Failure to do so may result in unexpected costs or unfavorable terms.

Take the time to review the loan estimate and closing disclosure provided by your lender. If there are any terms or conditions that you don’t understand or have concerns about, don’t hesitate to ask your lender for clarification. It’s important to have a clear understanding of the terms before proceeding with the refinancing.

4. Failing to consider the long-term costs

When refinancing, many borrowers focus solely on the immediate savings or benefits they will receive. However, it’s important to consider the long-term costs and implications of the refinancing.

While refinancing may lower your monthly payments or provide short-term savings, it could result in a longer repayment period or higher overall costs.

Before refinancing, use online calculators or consult with a financial advisor to evaluate the long-term costs and benefits of the refinancing. Consider factors such as the total interest paid over the life of the loan and the potential impact on your overall financial goals.

This will help you make an informed decision and avoid any unforeseen financial burdens in the future.

Tips for negotiating better terms when refinancing with the same lender

Refinancing your mortgage can be a great way to save money on interest rates and potentially lower your monthly payments. If you’re considering refinancing with the same lender, it’s important to know that you still have the opportunity to negotiate better terms. Here are a few tips to help you navigate the refinancing process and secure more favorable terms:

- Research current interest rates: Before approaching your lender, take the time to research the current interest rates in the market. This will give you a benchmark to compare the rates offered by your lender and help you identify if they are competitive.

- Review your credit score: A high credit score can significantly impact the terms and interest rates you qualify for during refinancing. Before negotiating with your lender, request a copy of your credit report and check for any errors. If you find any inaccuracies, dispute them and work towards improving your credit score.

- Highlight your payment history: If you have been consistently making your mortgage payments on time, be sure to emphasize this to your lender. A strong payment history can demonstrate your reliability as a borrower and may increase your chances of securing better terms.

- Show loyalty as a customer: If you have a long-standing relationship with your lender and have been a loyal customer, leverage this when negotiating. Highlight the fact that you have been with them for a significant period of time and have a good track record.

- Compare refinancing options: Don’t limit yourself to only refinancing with your current lender. Research other lenders and compare their rates and terms. This will give you additional negotiating power as you can potentially use competing offers to negotiate better terms with your current lender.

- Seek professional advice: Consider consulting with a mortgage broker or financial advisor who can provide expert guidance on refinancing. They can help you navigate the negotiation process and ensure you’re making informed decisions.

- Be prepared to negotiate: Approach the negotiation process with confidence and be prepared to negotiate for better terms. Clearly communicate your goals and expectations to your lender and be open to finding a mutually beneficial solution.

- Consider paying points: If you’re looking to further reduce your interest rate, you may consider paying points. Points are essentially prepaid interest that you can pay upfront to lower your interest rate over the life of the loan. Evaluate whether paying points aligns with your financial goals before discussing it with your lender.

- Review and understand the terms: Before finalizing the refinancing agreement, carefully review and understand all the terms and conditions. If there are any clauses or fees that you’re unsure about, don’t hesitate to ask for clarification. It’s essential to have a clear understanding of what you’re agreeing to.

- Document all agreements: Once you’ve successfully negotiated better terms, ensure that all agreements are documented in writing. This will help protect both parties and provide clarity on the agreed-upon terms.

Frequently Asked Questions

Can I refinance my car loan through the same lender?

Yes, it is possible to refinance your car loan with the same lender. However, it is advisable to explore other lenders as well to compare interest rates and terms. This will help you find the best refinancing option that suits your needs and saves you money in the long run.

Conclusion

In conclusion, refinancing your car loan through the same lender can be a convenient option if you are satisfied with their services and terms. It can save you time and paperwork as you won’t have to establish a new relationship with another lender.

However, it’s important to assess whether refinancing with the same lender offers better interest rates, loan terms, and benefits compared to other lenders. Shop around and compare offers to ensure you are getting the best possible refinancing deal.

Remember, refinancing can help lower your monthly payments or reduce the overall cost of your loan, so it’s worth exploring your options.