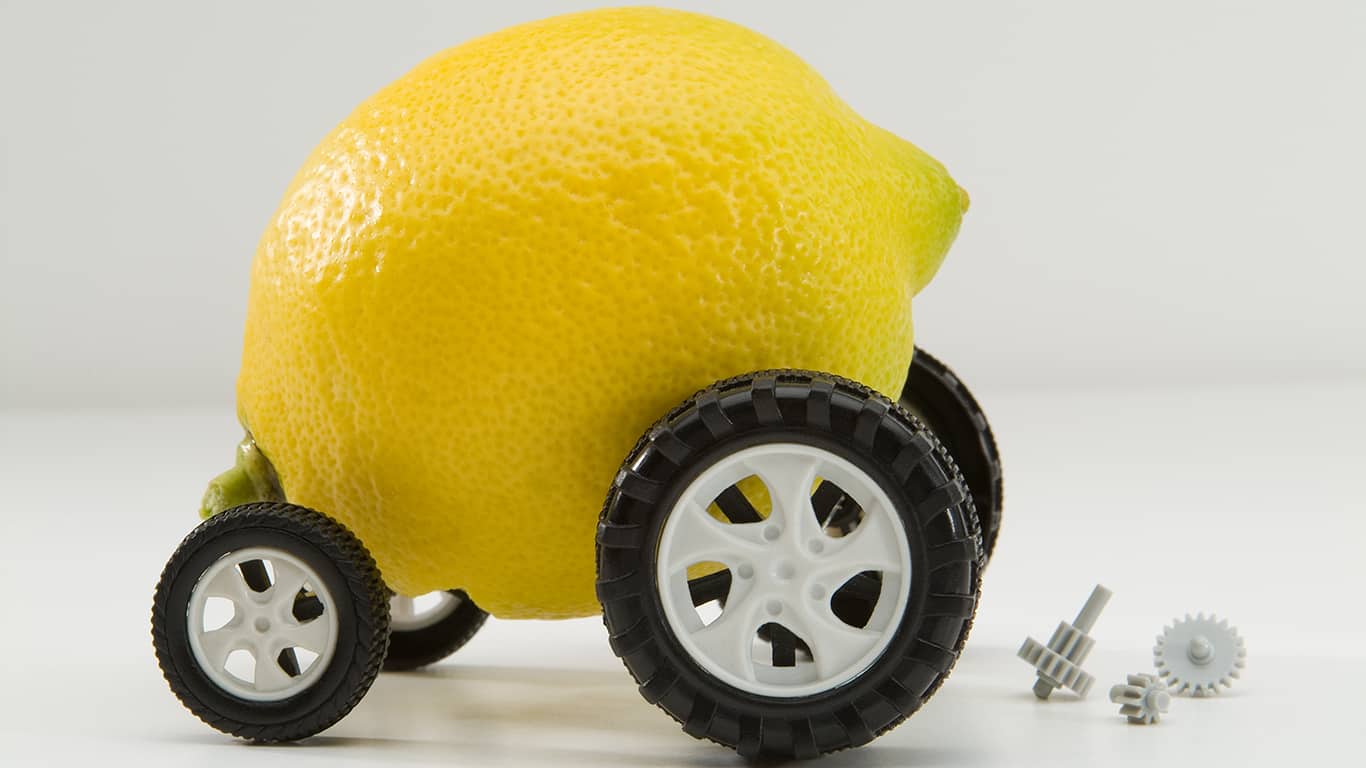

Are you facing the dilemma of owning a lemon car and need some financial assistance? Don’t worry, we’ve got you covered. Getting a loan on a lemon car is indeed possible, and we are here to help you navigate through the process.

Whether it’s a bad credit score or the condition of your car, our specialized loan options cater to all situations. With competitive rates and flexible repayment terms, we ensure that you can get the necessary funds to address your immediate needs without any hassle.

Can you get a loan for a lemon car?

If you’ve purchased a lemon car, which is a vehicle that has significant defects or mechanical problems, you may find yourself in a difficult situation. Not only do you have to deal with the frustrations of owning an unreliable automobile, but you may also have concerns about financing. Can you still get a loan for a lemon car?

Let’s explore this question.

1. Lemon car and its implications

Before diving into the loan aspect, it’s important to understand what exactly constitutes a lemon car and its implications. A lemon car typically refers to a vehicle that has recurring manufacturing defects that impair its use, value, or safety. These defects usually persist even after several repair attempts, making the vehicle unreliable and potentially dangerous.

Driving a lemon car can be a frustrating experience. You may face frequent breakdowns, costly repairs, and a diminished resale value. In many cases, lemon cars can also pose safety risks, making them less desirable for lenders.

2. Traditional lenders and lemon cars

In most cases, traditional lenders such as banks and credit unions may be hesitant to provide loans for lemon cars. The reason is simple – they consider lemon cars to be high-risk purchases. Lenders worry that financing a lemon car could lead to default or repossession if the borrower struggles with constant repairs and depreciation.

Furthermore, lemon cars often have diminished resale value, which means they may not be sufficient collateral for the loan. Lenders rely on the vehicle’s value to mitigate their risk. If the car’s value is significantly reduced due to its lemon status, it becomes harder to secure a loan.

3. Alternative financing options

While traditional lenders may be reluctant to provide loans for lemon cars, there are alternative financing options available:

- Specialized lemon car lenders: Some lenders specialize in providing loans for individuals with lemon cars. These lenders understand the unique challenges associated with lemon cars and may be more willing to offer financing options.

- Bad credit lenders: If you’re facing credit challenges and have a lemon car, bad credit lenders may be more lenient in their loan requirements. However, be prepared for higher interest rates.

- Personal loans: Depending on your creditworthiness and financial situation, you may consider obtaining a personal loan to finance your lemon car. However, personal loans typically have higher interest rates compared to auto loans.

4. Considerations before getting a loan for a lemon car

Before pursuing a loan for a lemon car, there are a few essential factors to consider:

- Repair costs: Evaluate the potential repair costs of the lemon car. If the repairs are extensive and costly, it might not be financially wise to take on additional debt.

- Interest rates and loan terms: If you’re able to secure a loan, carefully review the interest rates and loan terms. Higher interest rates can significantly impact the overall cost of the loan.

- Alternative transportation: Assess whether alternative transportation options, such as public transportation or car-sharing services, might be more cost-effective than financing a lemon car.

5. Seeking legal recourse

If you’ve purchased a lemon car and are struggling to obtain financing, it may be worthwhile to explore legal recourse. Lemon laws vary by jurisdiction, but they generally aim to protect consumers who have unknowingly purchased defective vehicles.

Consulting with a legal professional experienced in lemon law can provide guidance on potential remedies and options available to you.

Financing Options for Lemon Cars

Buying a car is a significant investment, and it can be quite frustrating if you end up with a lemon. Lemon cars are vehicles that have repeated defects or problems that substantially impair their safety, value, or use.

If you find yourself dealing with a lemon car, you may be wondering what options you have for financing. In this section, we will explore the different financing options available for lemon cars and how they can help you navigate this unfortunate situation.

1. Return the Lemon Car

If you have purchased a lemon car, one of the first options you should consider is returning the vehicle to the dealer or manufacturer. Many states have lemon laws in place that protect consumers in these situations.

These laws typically require the manufacturer or dealer to either replace the lemon car or refund the purchase price. Returning the lemon car can save you from the burden of financing a defective vehicle and allow you to pursue other options.

2. Seek Legal Action

If returning the lemon car is not possible or satisfactory, you may need to consider seeking legal action. Consulting with an attorney who specializes in lemon law can help you understand your rights and options.

In some cases, you may be eligible for compensation for the lemon car’s purchase price, repairs, or other damages. While pursuing legal action may involve upfront costs, it can provide a way to recoup your losses and potentially finance a replacement vehicle.

3. Trade-in the Lemon Car

Another financing option for lemon cars is to trade-in the vehicle towards the purchase of a new or used car. While trading in a lemon car may not yield the highest trade-in value, it can be a viable solution if you need to secure alternative transportation quickly.

Some dealerships may be willing to offer you a trade-in allowance despite the lemon car’s condition, allowing you to apply that amount towards your next car purchase.

4. Private Sale

If the lemon car is still operational and you are comfortable with the potential legal implications, you may consider selling it privately. Selling the lemon car on your own can help you recoup some of your initial investment, which can then be used to finance a different vehicle.

However, it’s essential to disclose the lemon car’s condition and history accurately to potential buyers to avoid legal repercussions.

5. Financing a Replacement Vehicle

If you decide to pursue financing for a replacement vehicle, there are several options available. You can explore traditional auto loans from banks or credit unions, which typically offer competitive interest rates.

Alternatively, you may consider financing through a dealership. Dealerships often have relationships with multiple lenders, allowing them to offer financing options even to individuals with less-than-perfect credit or unique circumstances.

Additionally, if you have a good credit history, you may be eligible for special financing programs like 0% APR offers.

These programs can provide an opportunity to finance a replacement vehicle without incurring any interest charges, saving you money in the long run. It is always advisable to shop around and compare different financing options to ensure you secure the best terms and rates.

6. Consider a Certified Pre-Owned Vehicle

If you prefer not to finance a brand-new vehicle, another option is to consider a Certified Pre-Owned (CPO) vehicle. CPO vehicles undergo thorough inspections and come with extended warranties, offering peace of mind and protection against potential defects.

Many manufacturers and dealerships offer financing incentives, such as lower interest rates or special financing offers, specifically for CPO vehicles.

Is it possible to finance a lemon car?

Buying a car is a significant financial decision, and nobody wants to end up with a lemon – a defective vehicle that constantly requires expensive repairs. However, sometimes despite our best efforts, we may unknowingly purchase such a car. So, what happens if you find yourself stuck with a lemon car? Can you still finance it?

Let’s explore this topic in detail.

Understanding lemon cars

Before we dive into financing options for lemon cars, it’s crucial to understand what constitutes a lemon car. Generally, a lemon car is a vehicle that has a substantial defect or multiple defects that impair its use, value, or safety. Lemon cars often require repeated repairs or have defects that cannot be fixed even after multiple repair attempts.

Financing a lemon car

If you find yourself with a lemon car, the first step is to determine if the vehicle is covered by a manufacturer’s warranty or a state lemon law. Lemon laws vary by state, but they typically provide protection to consumers who purchase defective vehicles. If your car falls under the lemon law criteria, you may be eligible for a refund, replacement, or compensation from the manufacturer.

However, if your lemon car is not covered by a manufacturer’s warranty or the lemon law, financing options may become more challenging. Traditional lenders such as banks and credit unions may be hesitant to provide financing for lemon cars due to the higher risk involved.

Alternative financing options

While obtaining traditional financing for a lemon car may be difficult, there are alternative financing options to consider:

- Buy-here-pay-here dealerships: These dealerships specialize in financing vehicles for individuals with poor credit or unique financial situations. They may be more willing to finance a lemon car, but be aware that the interest rates may be higher, and the terms may not be as favorable.

- Specialized lenders: Some lenders specialize in financing vehicles with salvage titles or other issues. These lenders may be more willing to work with individuals who have lemon cars, but again, the interest rates and terms may not be as competitive.

- Private financing: In some cases, you may be able to find a private lender or an individual willing to finance your lemon car. This option may require more effort and research, but it could provide a viable financing solution.

Before exploring alternative financing options, it’s essential to carefully evaluate the overall cost of financing a lemon car. Consider the interest rates, terms, and additional fees associated with the financing.

It’s also crucial to have the car thoroughly inspected by a trusted mechanic to ensure you understand the extent of the defects and potential repair costs.

Tips for getting a loan on a lemon car

If you find yourself in a situation where you need to get a loan for a lemon car, it’s important to proceed with caution. Buying a lemon car can be a frustrating experience, and getting a loan for one can add another layer of complexity. However, if you follow these tips, you can improve your chances of getting approved for a loan on a lemon car.

1. Research the lender

Before applying for a loan, take the time to research different lenders and find one that specializes in financing for lemon cars. These lenders are more likely to understand the unique challenges associated with lemon car financing and may have specific loan programs tailored to this situation.

Look for lenders who have experience working with borrowers in similar circumstances.

2. Check your credit score

Having a good credit score is important when applying for any type of loan, including one for a lemon car. Lenders will consider your credit history and score when determining your eligibility and the interest rate you’ll be offered.

Before applying for a loan, check your credit score and take steps to improve it if necessary. Pay off any outstanding debts, make all your payments on time, and consider disputing any errors on your credit report.

3. Gather documentation

When applying for a loan on a lemon car, it’s essential to have all the necessary documentation in order. This includes the vehicle’s title and registration, as well as any repair records and documentation related to the lemon law claim.

Having these documents readily available will help streamline the loan application process and demonstrate to the lender that you are organized and prepared.

4. Provide a detailed explanation

When filling out your loan application, be sure to provide a detailed explanation of the lemon car situation. Explain the issues you’ve experienced with the vehicle, any attempts at repairs, and the outcome of any lemon law claim. This information will help the lender understand why you are seeking a loan and provide context for your situation.

5. Consider a co-signer

If your credit score is not strong enough to qualify for a loan on a lemon car, consider finding a co-signer. A co-signer is someone who agrees to take on the responsibility for the loan if you are unable to make the payments. Having a co-signer with good credit can increase your chances of getting approved for a loan and may result in more favorable loan terms.

6. Be prepared for higher interest rates

Getting a loan on a lemon car may come with higher interest rates compared to traditional car loans. Lenders may view lemon cars as higher risk due to the likelihood of ongoing issues and potential for further repairs. Be prepared for this and consider shopping around for the best interest rates and loan terms.

7. Consider alternative financing options

If you are unable to secure a traditional loan for a lemon car, consider exploring alternative financing options. Some lenders specialize in subprime or bad credit loans and may be more willing to work with borrowers who have a history of credit challenges. However, be cautious with these lenders as they may offer less favorable loan terms and higher interest rates.

8. Get a pre-approved loan

Before visiting a dealership or private seller, consider getting a pre-approved loan for a lemon car. This will give you a clear understanding of your budget and financing options. Having a pre-approved loan can also give you more negotiating power when it comes to the purchase price of the vehicle.

9. Inspect the car thoroughly

Prior to finalizing the loan and purchasing the lemon car, it’s crucial to thoroughly inspect the vehicle. Bring a trusted mechanic or car expert with you to assess the car’s condition and identify any potential issues. This will help you make an informed decision and avoid further headaches in the future.

10. Consult with legal professionals

If you’ve had a particularly challenging experience with a lemon car, it may be worth consulting with legal professionals who specialize in lemon law cases. They can provide guidance and advice on your rights as a consumer and any potential legal recourse you may have.

5. Lemon car loans: What you need to know

When it comes to buying a car, the last thing you want is to end up with a lemon. A lemon car is a vehicle that has significant defects or mechanical issues that impair its safety, value, and utility. Unfortunately, lemon cars do exist, and they can be a nightmare for unsuspecting buyers.

If you find yourself stuck with a lemon car, you may be wondering what your options are. One possible solution is to consider a lemon car loan. In this section, we’ll discuss what lemon car loans are, how they work, and what you need to know before considering this option.

What is a lemon car loan?

A lemon car loan is a type of loan specifically designed for individuals who have purchased a lemon car. This loan can help you cover the costs of repairs or even finance a new vehicle, depending on your situation and needs.

Typically, lemon car loans are offered by specialized lenders who understand the challenges faced by lemon car owners. These lenders take into account the diminished value of your lemon car and may offer more flexible terms compared to traditional car loans.

How do lemon car loans work?

When applying for a lemon car loan, the lender will assess the condition and value of your lemon car. They will also consider the extent of its defects and the estimated costs of repairs. Based on this information, they will determine the loan amount and interest rate.

It’s important to note that lemon car loans typically have higher interest rates compared to regular car loans. This is due to the increased risk associated with financing a vehicle with known defects. However, the exact terms and rates may vary depending on the lender and your individual circumstances.

If approved for a lemon car loan, you can use the funds to cover the costs of repairs or as a down payment for a new vehicle. Some lenders may even provide financing options to help you purchase a different car altogether if your lemon car is beyond repair.

What should you consider before getting a lemon car loan?

Before considering a lemon car loan, there are a few important factors to keep in mind:

- Eligibility: Lemon car loans may have specific eligibility criteria. Make sure you meet the requirements before applying.

- Costs: Consider the total costs of the loan, including interest rates, fees, and any additional charges.

- Reputation of the lender: Research the lender’s reputation and read reviews from previous customers to ensure they are trustworthy and reliable.

- Alternative options: Explore other alternatives, such as seeking legal recourse or negotiating with the car manufacturer or dealer.

FAQs

Can you get a loan on a lemon car?

It is generally difficult to get a loan on a lemon car. Lemon cars have significant mechanical or safety issues, making them risky investments for lenders. Most lenders require a vehicle to pass inspections and meet certain criteria before approving a loan.

Conclusion:

In conclusion, getting a loan on a lemon car can be a challenging endeavor with potential financial risks. It is important to thoroughly assess the condition and value of the lemon car before considering any financing options. While some lenders may still offer loans on such vehicles, the interest rates and terms may be less favorable due to the higher risk involved.

Additionally, the overall cost of owning a lemon car, including repairs and maintenance, should be carefully weighed against the potential benefits of getting a loan. Seeking expert advice and exploring alternative options, such as trading in the lemon car or saving for a more reliable vehicle, might be a more prudent choice in the long run.